Health Insurance Vs Critical Illness Insurance For Critical Illness May Add Security But At A Cost The New York Times

Health insurance vs critical illness Indeed lately has been hunted by users around us, perhaps one of you personally. People are now accustomed to using the net in gadgets to see image and video information for inspiration, and according to the title of this article I will discuss about Health Insurance Vs Critical Illness.

- Long Term Care Vs Long Term Disability Vs Critical Illness Insurance Nea Member Benefits

- Supplement Your Health Insurance With Top Up Critical Illness Covers

- Critical Illness Insurance Plan Should You Buy Personal Finance Plan

- Is Your Health Insurance Plan Adequate To Cover Critical Illness

- What Is The Difference Between Health Insurance And Mediclaim And Which One Is Better And Why Quora

- Critical Illness Insurance Plan Should You Buy Personal Finance Plan

Find, Read, And Discover Health Insurance Vs Critical Illness, Such Us:

- 10 Best Critical Illness Insurance Policies In Singapore 2020

- Are You Covered For Critical Illnesses Imoney

- 9 Shocking Facts About Health Insurance Vs Medical Insurance Health Insurance Vs Medical Insurance In 2020 Private Health Insurance Shocking Facts Health Insurance Policies

- Critical Illness Insurance Plans And Coverage Benefits Unum

- Do You Need Critical Illness Cover Choose Your Health Insurance Etniki Or Othe

If you are looking for Good Health Kindergarten you've arrived at the perfect place. We ve got 104 graphics about good health kindergarten adding images, photos, pictures, wallpapers, and much more. In these webpage, we also provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

Disability Insurance Vs Critical Illness Insurance And Why You Should Have Both Ax Iz Financial Solutions Inc Good Health Kindergarten

Because these emergencies or illnesses often incur greater than average medical.

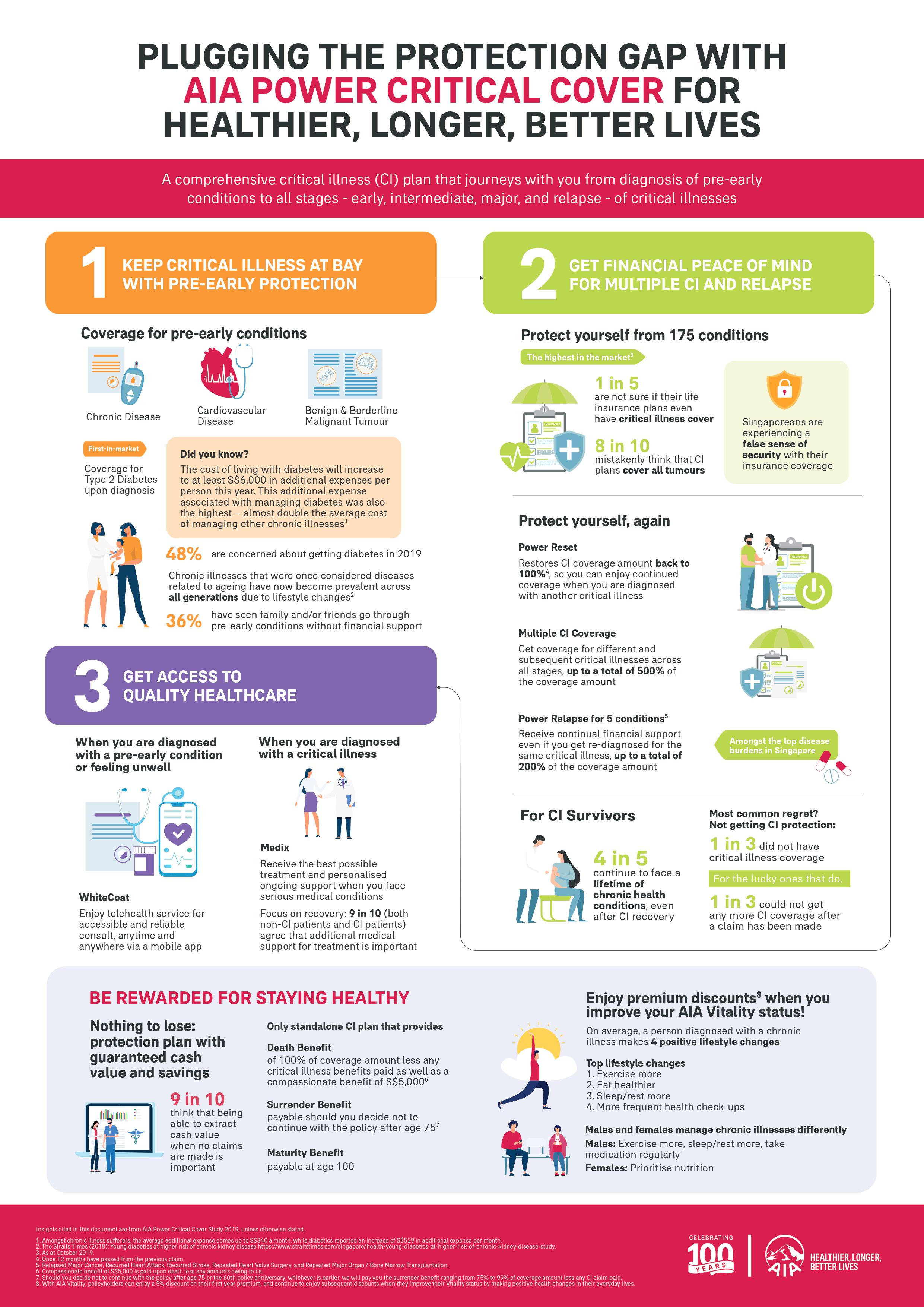

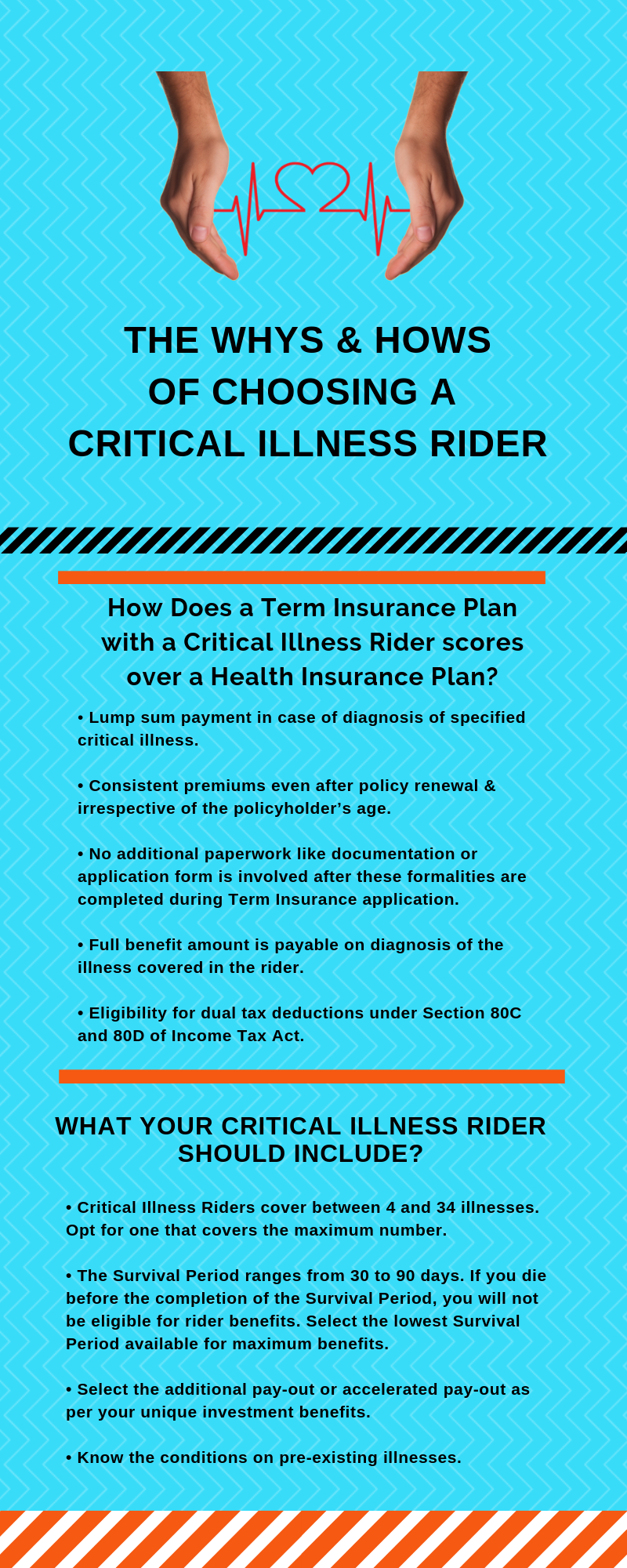

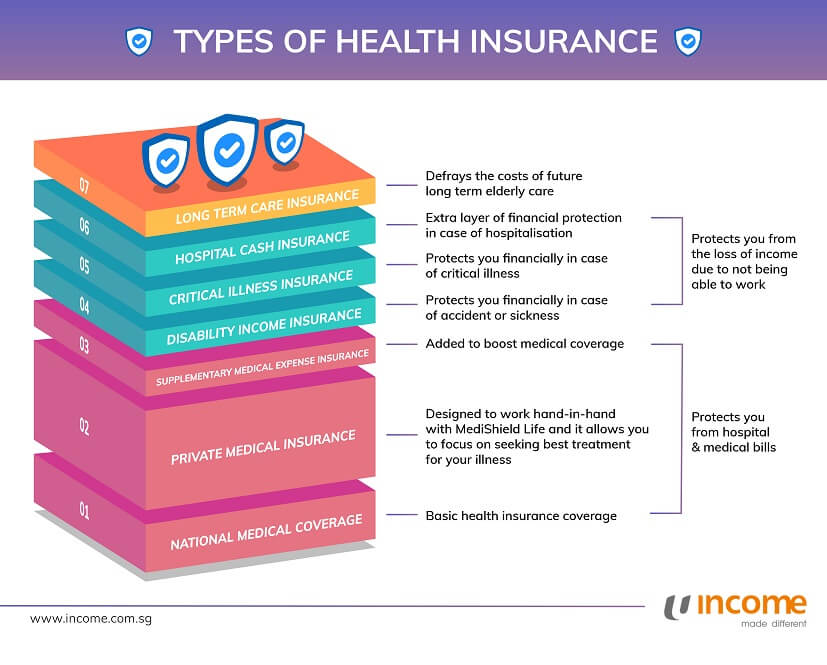

Good health kindergarten. The choice depends on your medical condition. Health insurance plans allow a higher coverage amount compared to critical illness plans. Critical illness cover critical illness cover is different from permanent health insurance in a number of ways.

Typically a health insurance plan is availed for a year and then renewed year on year. However critical illness plans do not have such high coverage. Most health insurance plans provide critical illness rider cover on payment of additional premium that helps the insured pay for exorbitant hospitalization and treatment expenses.

On the other hand the best medical insurance for critical illness covers only certain pre determined medical conditions. The only difference is that a cancer plan is cancer specific whereas a critical illness insurance plan covers a large number of specified critical illnesses including cancer. However a critical illness insurance is usually bought for a longer duration of time for instance 15 to 20 years.

Unlike a regular indemnity health insurance policy that covers hospitalisation expenses a critical illness cover is a defined benefit plan that pays a lump sum sum insured if an individual is diagnosed with any of the critical ailments for example cancer or stroke as per the coverage. Critical illness insurance policy gives a financial benefit to the policyholders only when they suffer from any critical illness. Critical illness insurance provides additional coverage for medical emergencies like heart attack stroke or cancer.

There are health plans where the allowed sum insured goes as high as rs5 6 crores. Terminal illness insurance policy gives a financial benefit to the policyholders only when they have a terminal illness and their life expectancy is assumed to be less than 12 months. Thus the premium amount is also higher.

A critical illness health insurance policy is a benefit cover that pays the insured in a lump sum on diagnosis of a critical illness as specified in the policy document. What is critical illness policy. Critical illness insurance covers serious and long term illnesses that require an expensive medical treatment.

Critical illness plans or dread disease plans as they are sometimes known pay out. Under critical illness plans the maximum sum insured levels range between rs10 lakhs and rs25 lakhs.

More From Good Health Kindergarten

- Health Care Fish Oil Omega 3

- What Is Health Coverage

- Health And Safety Guidelines

- What Is Health Advocacy

- Good Health Kindergarten

Incoming Search Terms:

- Infographic Diseases Covered By Critical Illness Insurance Policies Good Health Kindergarten,

- Is Critical Illness Cover Worth It Moneysupermarket Good Health Kindergarten,

- Types Of Health Insurance In India Bajaj Allianz Good Health Kindergarten,

- Critical Illness Insurance Policy Best Critical Illness Insurance Cover Online Good Health Kindergarten,

- Best Health Insurance Plan With Critical Illness Cover In 2020 Wishpolicy Good Health Kindergarten,

- What Is The Difference Between Health Insurance And Critical Illness Insurance Insurancedeal Blog Good Health Kindergarten,