Health Insurance With Tax Credit Colorado S Proposed State Health Insurance Option Could Save Even More If Feds Contribute 42 Million In Tax Credit Savings

Health insurance with tax credit Indeed recently is being sought by users around us, maybe one of you. Individuals now are accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the title of the article I will talk about about Health Insurance With Tax Credit.

- New Health Insurance Marketplace Coverage Options For Small Businesses

- 3 11 29 Health Coverage Tax Credit Hctc Enrollment Processing Internal Revenue Service

- A Tax Credit Can Defray Premium Costs Kiplinger

- Summary Of The Small Business Health Insurance Tax Credit Under Aca Everycrsreport Com

- Health Insurance Tax Deduction Fy 2019 20 Ay 2020 21 Section 80d

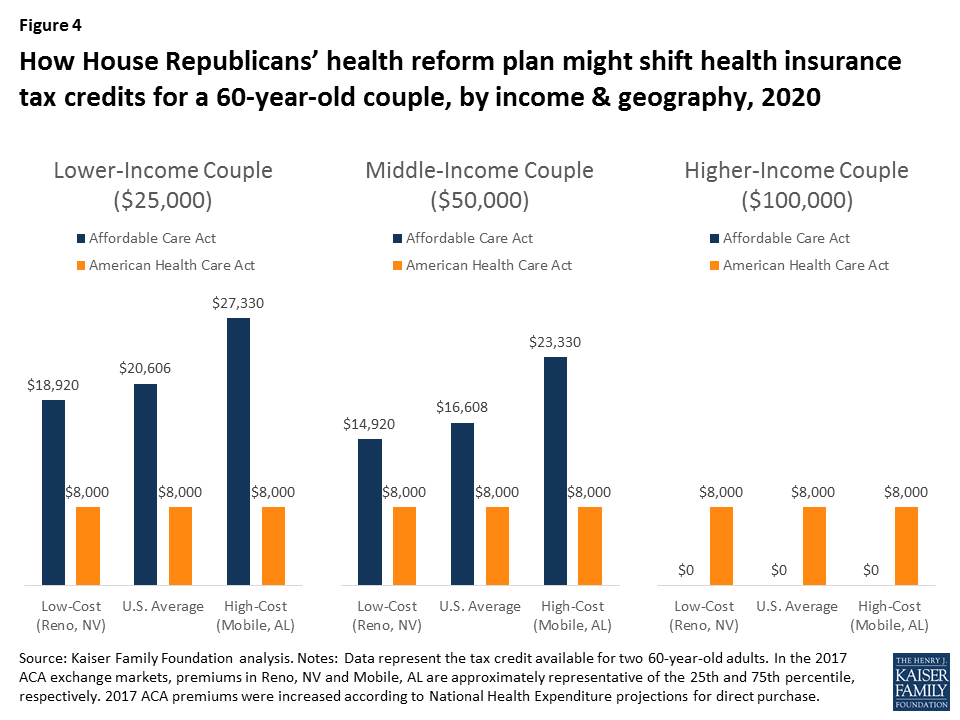

- Premium Tax Credits Health Affairs

Find, Read, And Discover Health Insurance With Tax Credit, Such Us:

- Your 1095 A Statement Washington Health Benefit Exchange

- Health Insurance Tax Credit Can You Claim The Credit

- Health Insurance Marketplace Advance Premium Tax Credit Youtube

- Small Business Health Care Tax Credit

- Obamacare Tax Credits For Health Insurance Tax Credits And Obamacare

If you are searching for Health And Safety Protocols For Covid 19 In Schools Philippines you've reached the right location. We ve got 101 graphics about health and safety protocols for covid 19 in schools philippines adding images, photos, photographs, wallpapers, and more. In these webpage, we also provide variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

If your estimated income.

Health and safety protocols for covid 19 in schools philippines. Changing plans after youre enrolled. A health insurance tax credit also known as the premium tax credit lowers your monthly insurance payment either through advance payments to your insurer or through your tax refund. The relief is given as a discount on the cost of the policy regardless of who the policy is for.

Credit karma tax always free learn more. Ways to apply for 2020 health insurance. Premium payments grace periods termination.

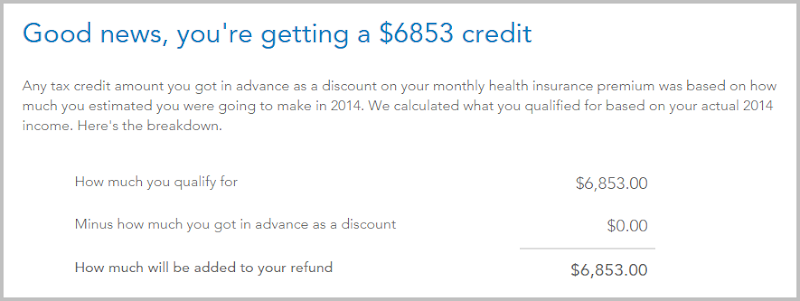

Who qualifies you are eligible for the premium tax credit if you. This means eligible individuals can receive a tax credit to offset the cost of their monthly health insurance premiums for 2020 if they have qualified health coverage for the hctc. How to apply if your income is too high for tax credits.

Quick facts about the health insurance tax credits. Extension of the credit the health coverage tax credit hctc a federal tax credit administered by the irs has been extended for all coverage months beginning in 2020. Qualifying medical insurance policies can be for.

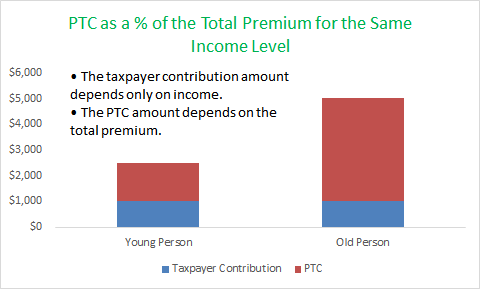

You can receive the tax credit in advance by having all or part of the money sent. Tax credits lower the cost of your premium. The tax credits help lower your insurance premium or the payments you make each month for your health plan.

To get this credit you must meet certain requirements and file a tax return with form 8962 premium tax credit. A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the health insurance marketplace. Complete your enrollment pay your first premium.

Tax reform didnt repeal the aca. The premium tax credit also known as ptc is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the health insurance marketplace. Tax credits help low and middle income individuals and families.

It was only 35 of eligible health insurance premiums from 2010 through 2013 and non profit employers can still only claim up to 35. Get help applying for health insurance. The small employer health care tax credit is equal to up to 50 of employer paid health insurance premiums as of 2019.

Preview health insurance plans prices. Tax credits reduce the amount of the premium you will pay for insurance. Instead it set to zero the penalty for going without health insurance.

This is known as tax relief at source trs. The so called individual mandate or health insurance tax was one of the most hotly debated aspects of the aca. You do not need to claim the tax relief from revenue.

Health and dental insurance combined.

Will You Owe Play Or Pay Penalties On Health Insurance James Moore Health And Safety Protocols For Covid 19 In Schools Philippines

More From Health And Safety Protocols For Covid 19 In Schools Philippines

- Health Insurance Germany

- Health Services Directorate

- Department Of Health Guidelines And Regulations

- Good Health For Heart

- What The Health Sinopsis

Incoming Search Terms:

- Private Health Insurance Expiration Of The Health Coverage Tax Credit Will Affect Participants Costs And Coverage Choices As Health Reform Provisions Are Implemented Kindle Edition By Gao U S Government Accountability Office What The Health Sinopsis,

- Health Insurance Tax Credit Faq What If My Income Changes What The Health Sinopsis,

- Sample Census Covered Ca Shop Small Business Health Insurance Benefit Agents What The Health Sinopsis,

- Small Business Health Care Tax Credit What The Health Sinopsis,

- Health Insurance Premium Tax Credit What The Health Sinopsis,

- Tax Software Bake Off Self Employed Health Insurance And Aca Premium Tax Credit What The Health Sinopsis,